Event overview

On Thursday, May 12th we heard from Sarrah Raza, Climate-Tech Analyst at BloombergNEF, on global climate-tech investment trends which have increased dramatically over the past decade, demonstrating a growing financial commitment to ensuring a successful energy transition. Michelle Chang, Program Manager on Google’s climate and infrastructure team, who discussed Google’s 24/7 Carbon-Free Energy as a Path to Net-Zero.

Meade Harris, CEO & Co-Founder Dynamo Energy and Benjamin Kafri, Global Head of Client Relations, Partnerships & Innovation Program, BloombergNEF gave an overview of the BloombergNEF partnership with Dynamo Energy Hub to facilitate innovation in the energy transition and talked about overview of the Pioneers program.

Click below to view Sarrah Raza’s slides.

Event Recap

If you listen long enough to any conversion about the clean energy transition, odds are you will eventually hear about the need for new climate technologies. Even as traditional renewable energy technologies like wind and solar drop in price, it has become clear to many in the energy and sustainability industries that in order to meet global carbon reduction goals, we will need to see the introduction and scaling of new climate technologies that will support, enhance, and smooth the transition. And unsurprisingly, this need for new tech has ushered in a surge of investment dollars into energy and sustainability-focused start-ups.

In order to understand the current trends in this surge of climate-tech investment, Dynamo Energy Hub and Bloomberg NEF invited climate tech investment experts to give their perspectives on what investment trends we should expect to see in the near future. Dynamo Energy Hub’s Co-Founder Meade Harris was joined by Benjamin Kafri, Global Head of Client Relations, Partnerships and Innovation at BNEF, Sarrah Raza, Climate Tech Investment Analyst at BNEF, and Michelle Chang, Program Manager of 24/7 Carbon-Free Energy at Google for a fascinating discussion last Monday.

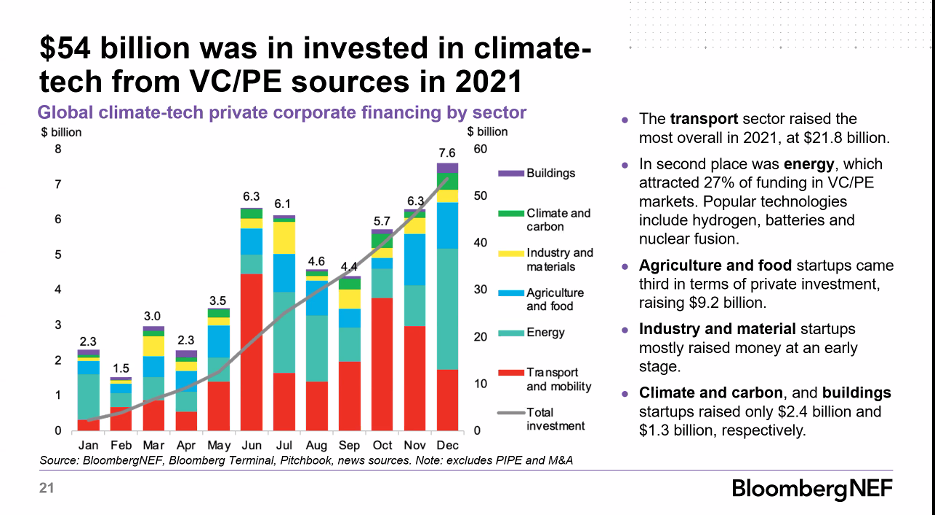

One of the most prominent features in climate tech investment to be aware of right now is the sheer scale of investment dollars that are being deployed to climate tech start-ups. In 2021, total global corporate financing of climate tech reached an astounding $165 billion. Investments focused on six main sectors–transport and mobility, energy, agriculture and food, industry and materials, climate and carbon, and buildings. And this trend doesn’t appear to be slowing–early analysis of 2022’s Q1 trends shows that last year’s total investment is on track to be topped this year.

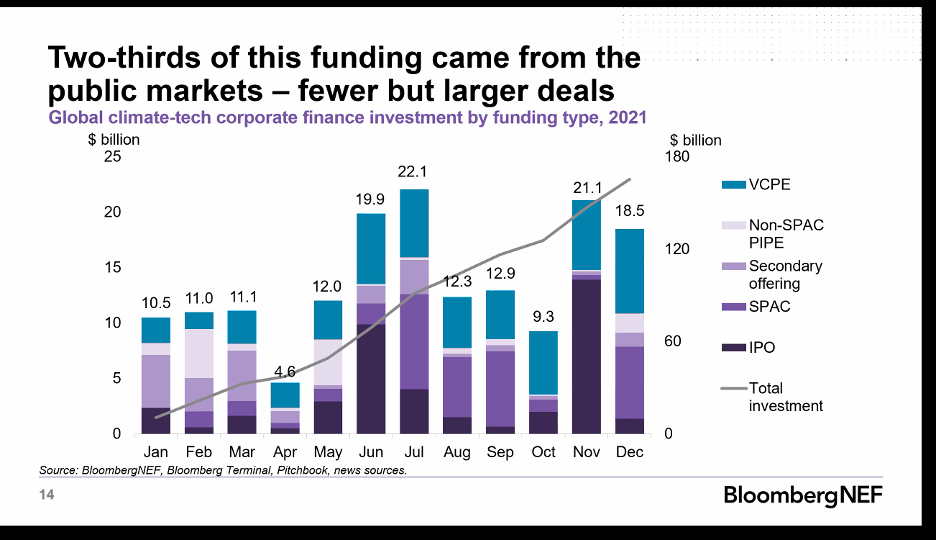

An interesting trend that Sarrah Raza pointed out is that while public markets accounted for the two-thirds of that $165 billion in investments, public markets had far fewer (albeit much larger) deals than private markets–483 deals to private market’s 2,800 deals. This feature may be especially interesting to start-up founders looking to secure investment money. While they may be a lower dollar amount, venture capital and private equity (VC/PE) deals are much more common than enormous public sector investment deals.

Caption: In this chart provided by Sarrah Raza, the purple bars represent public markets, while the blue bars represent private markets

The sectors that public and private markets invested in also differed slightly. While in both markets the energy and transportation were the two most invested-in sectors, in public markets the energy sector beat the transportation sector for the top slot, while in VC/PE deals it was reversed–the transportation sector was the most invested in.

Another interesting trend is that in the transportation sector both public and private markets favorite similar technologies–primarily electric vehicles, charging technology, and battery technology. However, in the energy sector, there is a clear distinction between the technologies preferred by each market. While public deals have primarily focused on established and mature technologies like wind and solar for investment, venture capital and private equity has more often focused on investing in less-established technologies like hydrogen and nuclear fusion. This is not surprising that venture capital firms and private equity investments are more willing to put investment dollars into ‘riskier’ technologies than public market deals, but it is interesting how this effect is much more noticeable in the energy sector than in the transportation sector.

Sarrah also called attention to the trends that venture capital and private equity markets seem to be displaying in the non transportation and energy sectors. Over the course of 2021, investment in agriculture and food start-ups picked up pace, with that sector coming in third overall. This was a massive increase in investment rates compared to the years prior to 2021. However, this interest in food and agriculture did not spread to public market investment deals; there were zero public market investment deals in agriculture and food startups in 2021, showing this to be a solely private market venture for now.

There may be a clear reason for the lack of investment in the other three sectors outside energy, transportation and agriculture. Climate and carbon tech startups are often more software-based and focus on data and censoring, so they require much less capital than the more material-based sectors, leading to fewer investment dollars being funneled their way. On the other hand, the industry/materials sector and the buildings sector occupy the other end of the materiality bell curve. These sectors require such an enormous and highly capital-intensive overhaul of material processes to decarbonize that they fail to receive investment as well. Sarrah Raza explained it like this:

“The industry and materials sector has taken longer to decarbonize than other sectors because to decarbonize that sector requires entire retrofitting of manufacturing processes–typically in older and more traditional companies–which is incredibly hard to do with start-up technologies. So the industry and materials sector is not any less important, but it is definitely one of the hardest of the six to decarbonize”

-Sarrah Raza

Lastly, there is an increasing trend in the use of SPACs for new start-ups to scale quickly and be brought to market. SPACs (or special-purpose acquisition companies) are publicly listed shell corporations that are created for the sole purpose of raising money for a start-up via an IPO. They can purchase a start-up and make it public without the start-up having to go through the traditional process of going public. These deals are especially popular for transportation start-ups, which made up 66% of SPAC deals in 2021.

“SPACs have been a very popular method for climate tech startups to scale in the last year. 50 startups last year raised 35 billion dollars from SPACs and pipe investments to go public.”

– Sarrah Raza

These private investment trends were reinforced by Google and BloombergNEF’s recent investment focuses. As one of the most aggressive and forward-thinking large energy consumers, Google has set incredibly challenging goals for decarbonization. Michelle Chang explained how the goal of 100% 24/7 carbon-free energy by 2030 is much harder to accomplish than simply carbon neutrality. Google is aiming for all operations across the world to be powered by carbon-free energy sources in real-time–as opposed to using PPEs and offsets like many other companies use to claim carbon neutrality.

In order to accomplish these goals, Google understands that new technologies must become available in coming years. In order to support these new technologies, Google’s investment strategy involves it becoming the first customer and investor for small climate tech start-ups in order to provide these new technologies the support they need to perfect and scale their product. By doing this, Google forms a long-term relationship with these start-ups and fills an important gap in funding between small start-ups that often receive VC money and large solar or wind projects.

“Our theory of change when it comes to emerging climate technologies is focused on catalyzing the deployment of first of a kind commercial projects by serving as the first commercial customer for these emerging energy technologies. These technologies are still fairly nascent and expensive today but we think a lot of them have a really promising shot of reaching material scale by 2030.”

– Michelle Chang

BloombergNEF also has been focusing on identifying emergent climate technologies. Benjamin Kafri described the BNEFPioneers program, which annually picks three net-zero challenges and solicits applications from start-ups and new technologies that address these challenges. Applicants are selected based on their potential impact, innovation, and the likelihood of adoption. Selection as a BNEFPioneer is an important recognition that supports the scaling and marketability of the products that Pioneers create. In this way, BNEF supports new and emergent technologies in the climate sector.

Many of Dynamo’s members intimately know the challenge of securing the necessary investment dollars to scale up their cleantech products. But these trends expressed by the panelists should excite climate start-ups looking for investors. The market is hot right now, and it looks like it will continue to heat up in coming months and years. Here at Dynamo, we understand that the secret ingredient that accelerates investment of all sorts is human connection. That’s why we provide forums and events like this one to foment those relationships that lead to the partnerships necessary to usher in the technologies of tomorrow. Thank you to all who attended this event, and a special thanks to all of the panelists that joined us, we hope to see more of you at future Dynamo Energy Hub Events.

–

If you are interested in apply to for the BNEF Pioneers program, the application for the 2023 Pioneers opens at the beginning of 4Q 2022 and will be available at this link.

Climate-Tech Investment Trends

Thursday, May 12 2022

12:00 PM - 1:00 PM EST

Speakers

Benjamin Kafri

BloombergNEF

Global Head of Client Relations

Sarrah Raza

BloombergNEF

Technology and Innovation team

Meade Harris

Dynamo Energy Hub

Founder & CEO

Michelle Chang

Program Manager

Agenda

12:00 pm EST

Dynamo Welcome Speech

Meade Harris, Co-Founder and CEO at Dynamo

12:10 pm EST

Opening Remarks

Benji Karfi, Global Head of Client Relations at BloombergNEF

12:30 pm EST

Climate-Tech Investment Trends

Sarrah Raza, Technology and Innovation team at BloombergNEF

12:45 pm EST

Google’s 24/7 Carbon-Free Energy as a Path to Net-Zero

Michelle Chang, Program Manager at Google

1:00 pm EST

Q&A Portion & Final Remarks

A Q&A portion moderated by Meade Harris, followed by her final remarks.

Sponsors

Climate-Tech Investment Trends