Event overview

BloombergNEF Partnership

On Tuesday, June 7th, Dynamo Energy Hub partnered with BloombergNEF on the first inaugural Sustainable Commodities Forum. BloombergNEF began 20 years ago in London as a strategic research provider and continues operating today as a global team studying energy, finance, and emerging technology.

2022 Sustainable Commodities Forum

BloombergNEF’s Brent Smelter kicked off the forum with introduction from Shira Guedalia, also from BloombergNEF. He noted that sustainable commodities play an increasingly important role in the transition to a low carbon economy, particularly as ESG regulations become more strict. Over the evening, the Forum’s speakers shared commodity markets trends alongside the growing global focus on net-zero energy targets. Energy security, rising oil and gas prices, innovating across sector expertise to reduce emissions, and climatetech trends were all featured in the evening’s conversation.

BloombergNEF’s Brent Smelter kicked off the forum with introduction from Shira Guedalia, also from BloombergNEF. He noted that sustainable commodities play an increasingly important role in the transition to a low carbon economy, particularly as ESG regulations become more strict. Over the evening, the Forum’s speakers shared commodity markets trends alongside the growing global focus on net-zero energy targets. Energy security, rising oil and gas prices, innovating across sector expertise to reduce emissions, and climatetech trends were all featured in the evening’s conversation.

Commodity Supercycles & Net-Zero Targets

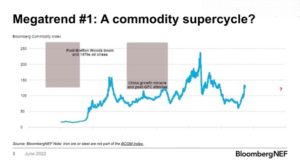

Ashish Sethia, Global Head of Commodities, Energy & Environmental Markets at BloombergNEF began by sharing his research on the rise of two megatrends in the capital markets that relate to the energy industry. First, he addressed the Commodity Supercycle, which he defined as a period of approximately 10 years when commodity prices continue to rise quickly. In a supercycle, high commodity prices are caused by an increase in growth and demand, alongside a lack of investment in the supply side. This comes following 2 years of low investment in natural resources, and inflation at a 20-year high. We see the impact of the supercycle in renewable energy as well. Although the cost of renewable energy development has come down in recent years, capital expenditures for solar and wind energy projects are 10-15% higher than last year due to the increased price of metals.

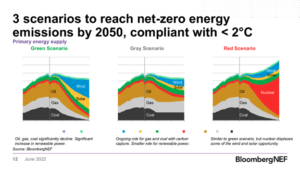

The second major trend is the increased focus on Net-zero targets. Today, 90% of countries have committed to net-zero targets, and in order to achieve this goal, he shows three projected scenarios:

What happens when net zero goals align with a commodity supercycle? Ashish spoke to how new, sustainable commodities are expected to emerge in the next 2-3 decades. Electricity markets may triple in size globally should the first ‘Green scenario’ become the path to net-zero. If net-zero targets are not met, electricity markets are still expected to double their current size.

Watch Ashish’s presentation for more details.

Energy Security with Net-zero targets

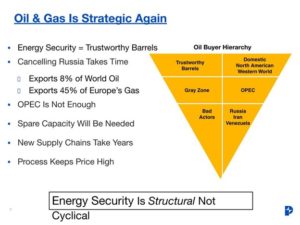

Dan Pickering, Founder of the research and consulting firm Pickering Energy Partners, focused on the strategic question of energy security in global markets following Russia’s invasion of Ukraine. This sudden dramatic shift also comes at a time when supply chains are still affected by the pandemic. Russia produces about 10% of the total global daily consumption (100 million barrels/day) and provides almost half the natural gas to Europe. If we want trustworthy barrels from partners that follow a rule of law, he stressed that countries need to consider their own, their neighbors’ and OPEC’s production before looking to ‘bad actors’ to meet their energy needs. “Energy Security is structural, not cyclical,” he highlighted.

Pickering projects that oil prices will remain at over $80 per barrel for the next 5 years unless the economy reverts to a recession. The net-zero megatrend, with 90% of governments maintaining a net-zero target and over 50% of S&P 500 companies pledging net-zero, demonstrates that institutional investors are committed to decarbonization. Consequently, in the years ahead, he expects the market will “spend trillions in transitioning to decarbonize, and trillions will be made in oil and gas as its happening.”

A New Partnership to reduce emissions while delivering energy

In this case study, Williams developed a partnership with Context Labs, Salantis, and Encino to create a vertically integrated solution to reduce methane emissions on their path to net-zero.

The team was challenged to measure and capture fugitive methane, ensuring it remains in pipes and doesn’t dissipate into the atmosphere during delivery. To collect this data, they worked with sensor providers Salentis and Encino to employ a suite of sensors to accurately measure methane. Encinco provided satellite technology for high resolution imaging to track methane and GHG emissions that can be difficult to spot in the field. Context Labs, a leading data management specialist in decarbonization, was able process large volumes of data to provide a clear understanding of fugitive emissions. Working with operators, the team devised a system to simplify the problem into one metric – creating a legible and accurate digital representation of the problem. This allowed Williams to get the data easily in the hands of decisionmakers and manage their assets better by investing in new technologies.

Nakul Nair of BloombergNEF, Matthew Berchtold of Context Labs, Aitor Munoz of Satlantis, Joe Etheridge of Encino, and Angela John of New Energy Ventures at Williams

Watch the full panel discussion here.

Fireside Chat with Kristin Barbato and Nathan Bullard

To conclude, Dynamo President and Co-Founder, Kristin Barbato and Nathaniel Bullard, BloombergNEF’s Chief Content Officer, sat down to discuss the state of climatetech in our current market. With interest rates rising and venture capital drying up, climatetech startups are challenged to focus on viable business models and more clearly define their value offering more quickly than over the past two years. Barbato highlighted that in the near term, there’s an urgent need for better collaboration models. “We believe energy innovation work can’t be done alone, and the last two years have shown that we need adaptive ways to work. At Dynamo, we are creating a platform to work in a flexible, collaborative, and interconnected way that supports the future of work in the energy sector.” As each region has its own energy sector ecosystem, Dynamo has developed a network of regional hubs to support cross-disciplinary and collaborative working models.

To conclude, Dynamo President and Co-Founder, Kristin Barbato and Nathaniel Bullard, BloombergNEF’s Chief Content Officer, sat down to discuss the state of climatetech in our current market. With interest rates rising and venture capital drying up, climatetech startups are challenged to focus on viable business models and more clearly define their value offering more quickly than over the past two years. Barbato highlighted that in the near term, there’s an urgent need for better collaboration models. “We believe energy innovation work can’t be done alone, and the last two years have shown that we need adaptive ways to work. At Dynamo, we are creating a platform to work in a flexible, collaborative, and interconnected way that supports the future of work in the energy sector.” As each region has its own energy sector ecosystem, Dynamo has developed a network of regional hubs to support cross-disciplinary and collaborative working models.

Bullard also believes the energy sector is spending “too much time focused on supply chains and not enough on value chains. We’re talking too much about Total Addressable Market, and not enough about Product-Market fit.” They both agree that commodities will continue to be an important focus in the transition to a low-carbon economy, including upstream mining and refining. Watch the full fireside chat for more insights.

Sustainable Commodities Forum

Tuesday, June 7 2022

4:00 - 8:00 PM CST

Austin, Texas

Speakers

Kristin Barbato

Dynamo Energy Hub

Founder

Brent Smelter

BloombergNEF

Head of Business Development

Shira Guedalia

Bloomberg L.P

Energy Corporate accounts in Texas and Oklahoma

Ashish Sethia

leads a global group of energy, commodities and technology sector experts analyzing net-zero emissions pathways

Dan Pickering

Pickering Energy Partners

Chief Investment Officer

Angela John

Williams

Director of Innovation for New Energy Ventures

Nakul Nair

BloombergNEF

covers the national U.S. gas and LNG market

Joe Etheridge

Encino Environmental Services

founder and Chief Technical Officer

Matt Berchtold

Context Labs

Director of Climate Impact Initiatives and Director of Product Development

Aitor Moríñigo

Satlantis LLC

Executive VP

Nat Bullard

BloombergNEF

chief content officer

Agenda

4:35 - 8:00

Opening Remarks

Shira Guedalia, Senior Account Manager at BloombergNEF

Kristin Barbato, President & Co-Founder at Dynamo Energy Hub

Brent Smelter, Head of Commercial Western US/Canada at BloombergNEF

4:40

Sustainable Commodities: Where Net-Zero Meets the Supercycle

Ashish Sethia, Global Head of Commodities, Energy & Environmental Markets at BloombergNEF

5:00

The Push-Pull of Energy Security and Net Zero Ambitions

Dan Pickering, Founder, CIO at Pickering Energy Partners

5:15

Q&A

Moderator: Shira Guedalia, Senior Account Manager at BloombergNEF

Q&A for Ashish Sethia & Dan Pickering

5:20

Teamwork Makes the Net-Zero Dream Work: Creating Differentiated Commodities

Moderator: Nakul Nair, Senior Gas Associate, BloombergNEF

Angela John, Director of Innovation, New Energy Ventures

Joe Etheridge, Chief Technology Officer, Encino

Matt Berchtold, Vice President & General Manager, Context Labs

Aitor Moringo, Executive Vice President, Satlantis

5:55pm

Panel Q&A

6:00

Fireside Chat: Yesterday’s Solutions and Tomorrow’s Problems ACTUAL START

Nat Bullard, Chief Content Officer, BloombergNEF

Kristin Barbato, Co-Founder & President, Dynamo Energy Hub

6:25pm

Fireside Chat Q&A

Sponsors

Sustainable Commodities Forum