Expecting the Unexpected: Assessing Emissions Impacts and Physical Climate Risk in a Global Pandemic

Medium Friday, August 14th 2020At Dynamo Energy Hub’s virtual event this summer, the Rhodium Group’ energy and climate experts emphasized that the pandemic has not lowered greenhouse gas emissions to the point of mitigating climate change.

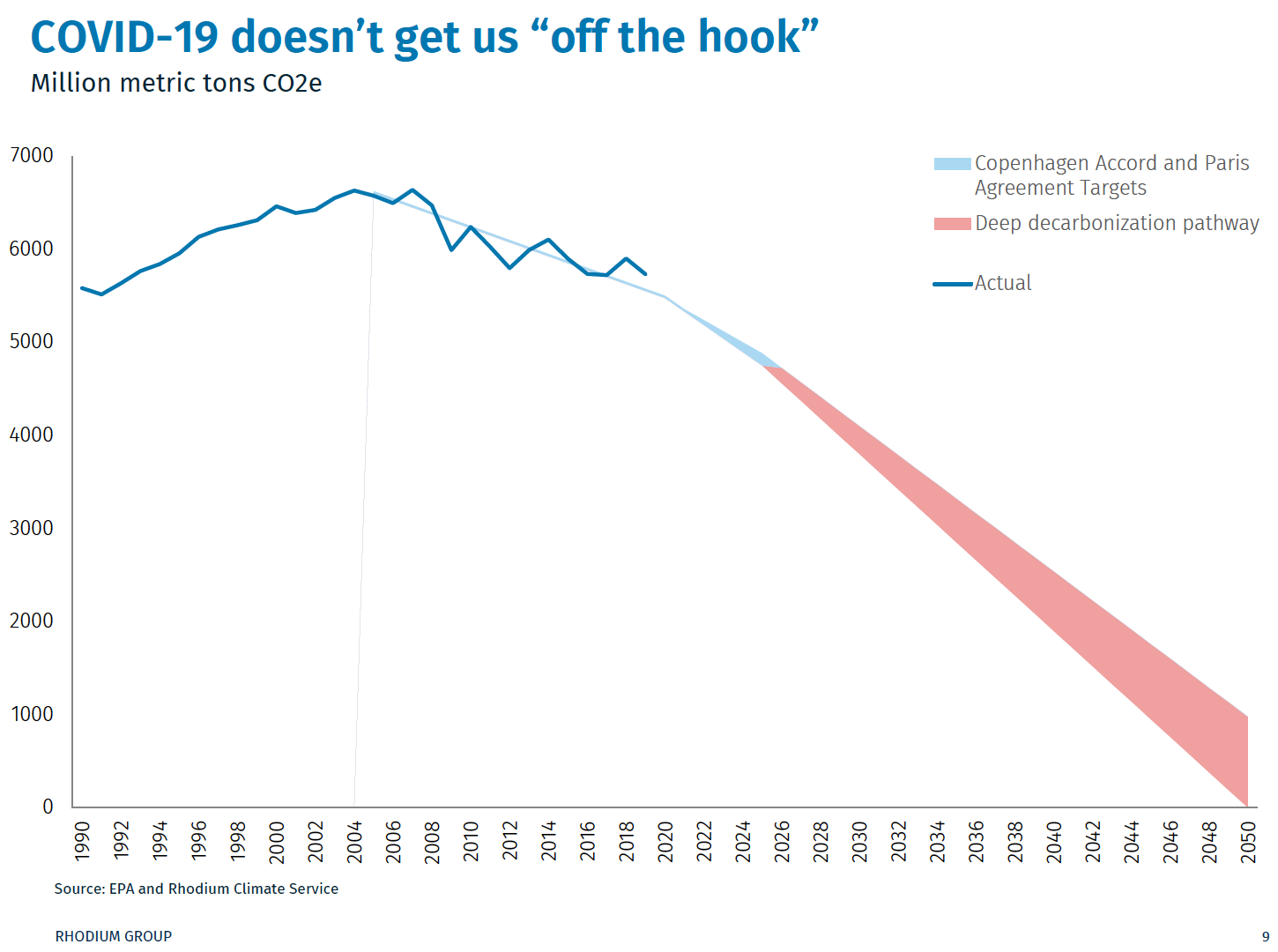

According to Emily Wimberger, Climate Economist at Rhodium Group: “While US emissions have fallen under the COVID-19 lockdown, we are still not on target for deep decarbonization and we will continue to face physical damages associated with climate change for the foreseeable future.”

Understanding and quantifying the risks of climate change has become increasingly important for investors, businesses, policymakers, and individuals. The Rhodium Group combines science and economics to first understand the trajectory of climate change in detail, and use this information to estimate and forecast precise economic impacts on real estate values, agricultural yields, and demand for commodities, to name a few.

How the virus and lockdown battered the economy?

Before laying out Rhodium’s emissions projections for the next ten years, Hannah Pitt, Senior Analyst for Climate & Energy at the Rhodium Group described energy market trends in the US in light of COVID-19. Oil took the hardest hit as non-essential travel sharply dropped: jets stayed grounded and cars parked. This led to a 30% decline in petroleum consumption year-on-year in mid-April.

While people stayed at home, electricity demand also shrank but by a smaller margin. At its peak decline, people used 16% less electricity than the previous year. Consumption recovered quickly, though: current demand is already only 4% below pre-COVID levels.

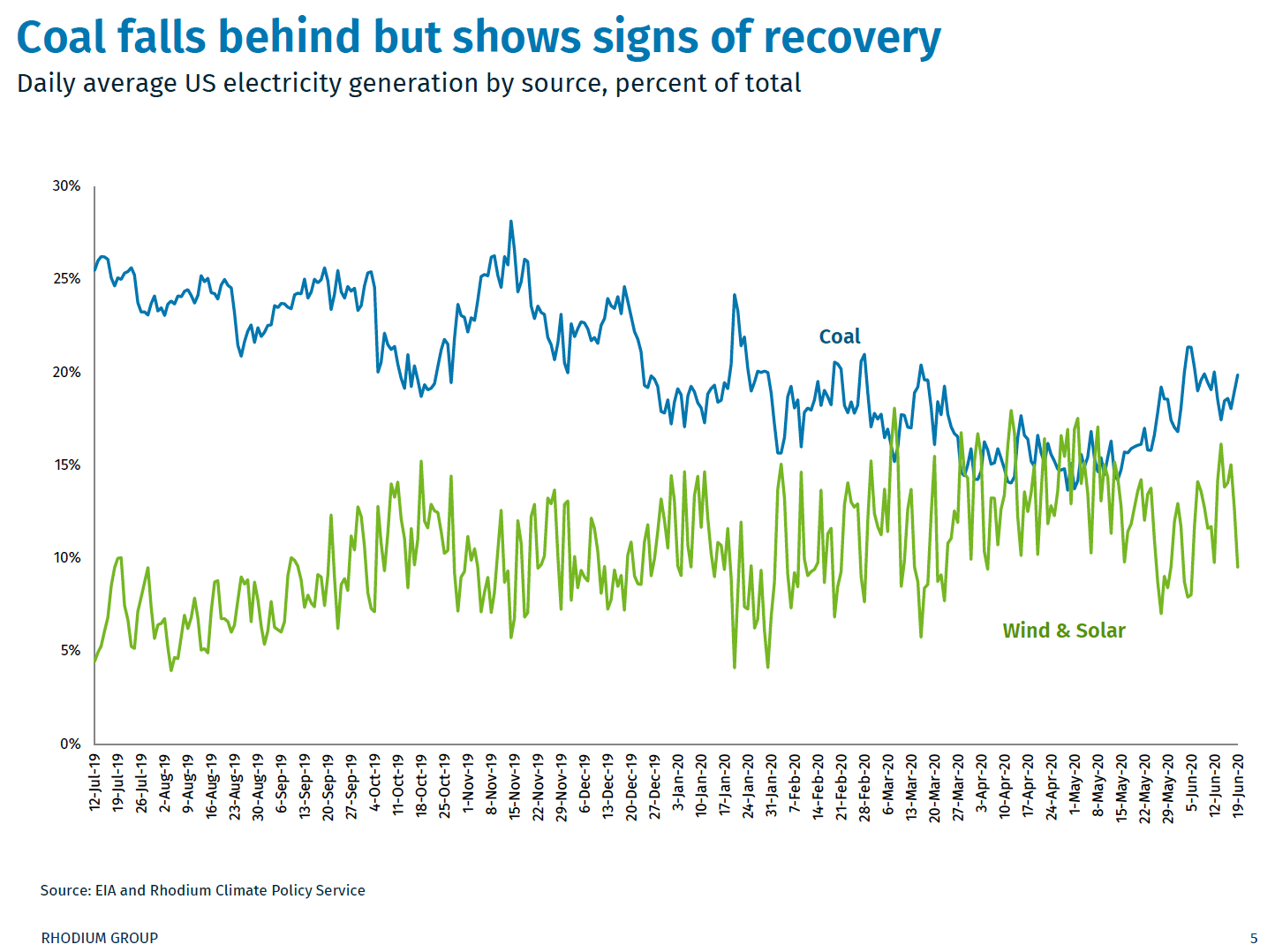

Decreased energy demand largely affected the more inefficient sources of power generation. Many coal power plants were shut off as they face significantly higher operating costs than wind, solar, and nuclear. In April, for the first time in recorded history, more energy was generated from renewable sources than from coal. Since then, coal powered generation has increased again.

In spite of this rebound, Pitt is certain that “the current pandemic and the economic slump are likely to continue the steady decline in coal that we have seen for many, many years to come.”

To date, coal usage has declined by 40% from its peak in 2008.

While both the transportation and power sectors already show strong signs of recovery, industrial production is still low. Driven by reduced demand for energy-intensive goods like cement, aluminum, and steel, the current industrial downturn has nearly reached Great Depression levels, with a 16% drop in production compared to 18% 90 years ago.

Two key lessons: GDP will stay down, emissions won’t

Rhodium Group offered two key takeaways from their research into this downturn. First, the recession will have a lasting economic impact: In 2017, nine years after the financial crisis, GDP levels were still 12% below Congress’ pre-crisis projections for that year.

Second, and more important, “Covid-19 is not a replacement for long-term climate policy”, as Pitt put it. “While emissions have fallen and might remain lower than anticipated, this is not a cause for celebration: reducing emissions by lowering economic growth is the most painful and expensive way to go about it.”

Rhodium estimates that the economic downturn and the subsequent reduction in emissions cost us between $2,500 to $3,000 per ton of reduced CO2 due to the loss in economic activity.

What to do? — Research, forecast, and prepare.

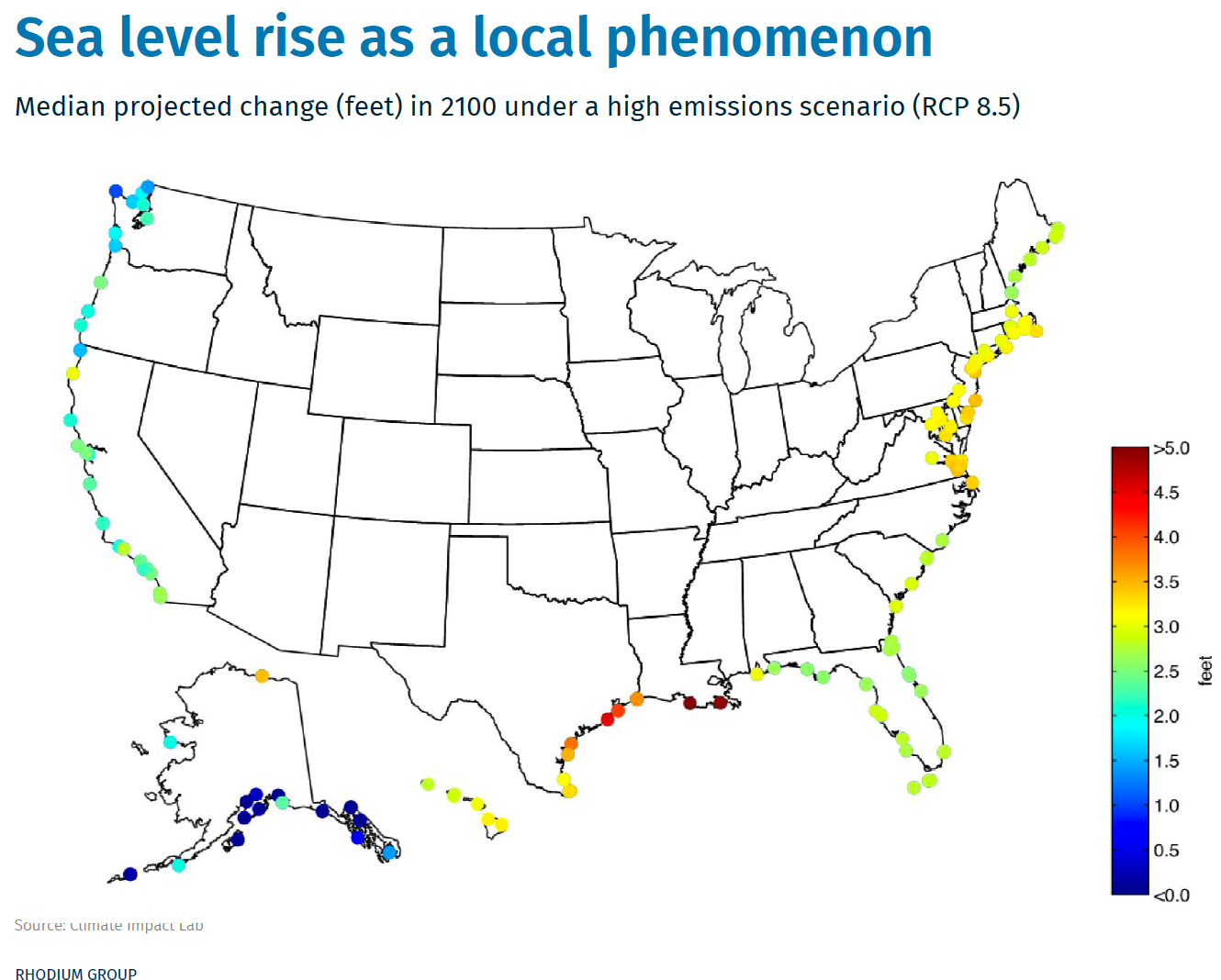

As the climate continues to change, Rhodium endeavors to understand the risks these changes pose to investments and livelihoods. But modeling the precise trajectory of both climate change and its effects is challenging. Sea level rise, for example: the shift in tides, melting ice shelf, local ocean-land dynamics, and many other factors all interact and must be factored in. Therefore, sea levels rise is difficult to project and can vary significantly depending on geographic area, as Grover-Kopec explained:

“A 2 ft global average rise in sea levels would cause a 5 ft level rise in Galveston on the Gulf Coast, and only half a foot or so in the Seattle area.”

The same holds true for hurricanes, precipitation changes, and inland flooding.

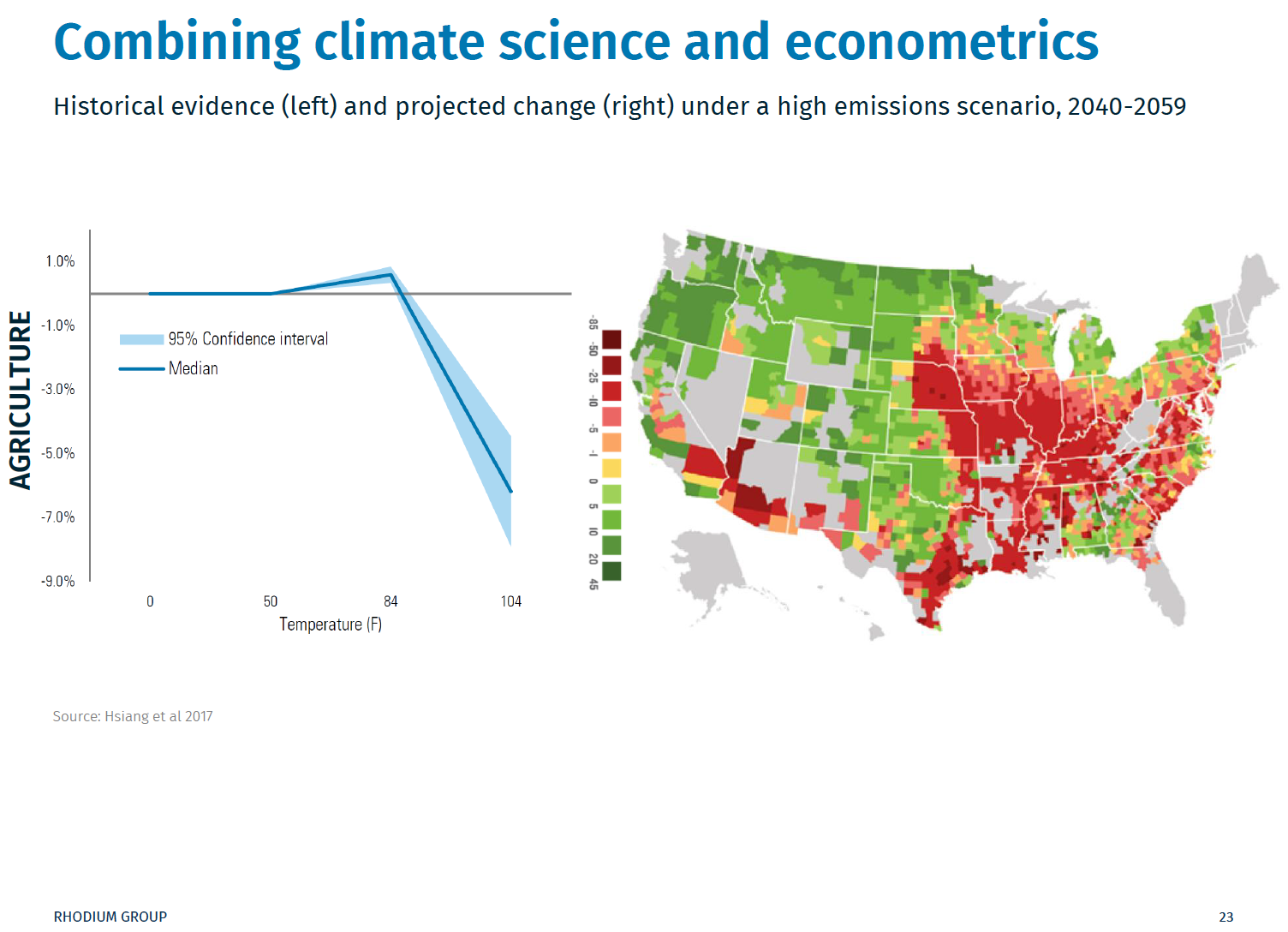

From their climate model, Rhodium experts are able to translate their insights into economic impacts: Will real estate values change? How much will energy prices rise? Collaborating with economists from the universities of Berkeley, Chicago and Rutgers, they found that most of the climate change effects on the economy are non-linear. This means that while higher temperatures might increase corn yields in the Upper Mid-West, the same temperature increase could turn regions further south uninhabitable. Rhodium finds similar impact on changes in electricity consumption, and even crime and mortality rates.

Rhodium’s energy and climate team expects climate change to lower global GDP by 0.39–7.57% every year. In comparison, Covid-19 and other pandemics on average are causing annual losses of 0.14–1%.

If you missed this event and would like to learn more, the event recording can be accessed here.

For media relations contact

Claudia Prandoni Marketing & Communications Manager