Special Purpose Acquisition Companies (SPACs) for Clean Energy Platforms

Medium Tuesday, November 3rd 2020Our latest Dynamo Virtual Hub Series event focused on the hot topic of Special Purpose Acquisition Companies (SPACs) and we were joined by a team of experts from Baker Botts LLP, including:

· Leslie Hodge, Associate, Global Projects, Baker Botts

· John Kaercher, Partner, Corporate, Baker Botts

· Elaine Walsh, Partner, Global Projects, Baker Botts

· Travis Wofford, Partner, Corporate, Baker Botts

The panel looked at the opportunities, constraints, and special considerations of SPACs as investment vehicles for cleantech and renewable energy targets. The speakers specifically focused on how the SPAC structure has been utilized to facilitate the growth and development of the energy transition.

Source: Baker Botts LLP

Key points from the discussion included:

· A SPAC is a financing tool that allows an investor to co-invest ‘publicly’ side-by-side with a best-in-class sponsor. The SPAC investor benefits from downside protections while the sponsor, if successful, is entitled to entrepreneurial economics.

· A publicly-listed SPAC is an acquisition vehicle whereby a sponsor team raises a blind pool of cash to acquire an operating company.

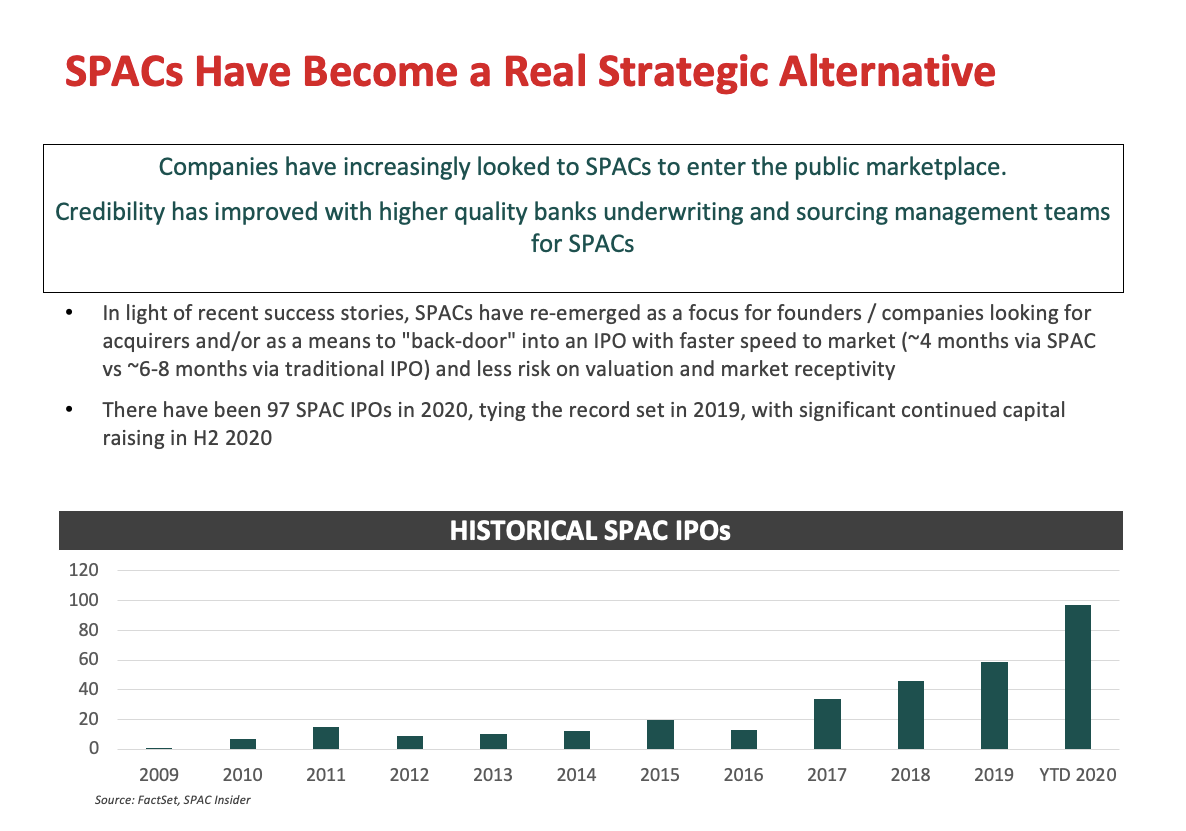

2020 saw 138 SPAC IPOs looking to raise $49.3 billion. Notably, over the last three years, there’s been 139 deals worth $30.6 billion invested, demonstrating that 2020 has been a banner year for SPACs.

· When discussing the differences between IPOs and SPACs, the speakers noted that most IPOs are expensive for new companies, as well as they are slow and risky because the price is determined by the market, and pricing certainty is realized at the very end of IPO process. IPOs require financial strength and a positive Wall Street outlook, while with SPACs the price is negotiated between the company and SPAC sponsor, therefore there’s more price certainty for the company earlier in the process.

· Companies only need to secure a SPAC sponsor and convince it in the growth opportunity, while with traditional IPOs a broad positive outlook of Wall Street is required, which is challenging for niche products and solutions like the ones offered by clean energy and sustainability startups.

Source: Baker Botts LLP

· Pre-revenue or pre-profit SPACs can use financial projections, whereas such projections are not permitted in traditional IPOs.

· For cleantechs, most of which lack broad market appeal, offer complex solutions, are capital intensive and pre-revenue, SPACs open up access to larger pools of capital earlier in their growth, specifically from investors focused on cleantech/ESG investing.

· Hence, SPACs tend to be cheaper, faster, safer, and more accessible to cleantech companies.

SPACs are an exciting new funding mechanism for cleantechs, which can help them grow faster as it connects cleantechs to the capital and investors they need to be successful earlier in their growth.

To learn more and watch the event replay, please visit the event page.

For media relations contact

Claudia Prandoni Marketing & Communications Manager